How to Create a Post-Wedding Budget

January 24, 2021 | ALL POSTS

There’s so much excitement that comes with planning a wedding that sometimes it’s easy to forget to plan for life as newlyweds! Life post wedding comes with many major decisions, especially when it comes to your finances. From sharing financial responsibilities, to designing a joint budget, to planning long-term purchases and investments, there’s a lot to consider. To help, we have curated a list of steps to help get you started so you can begin your lives together on the right track.

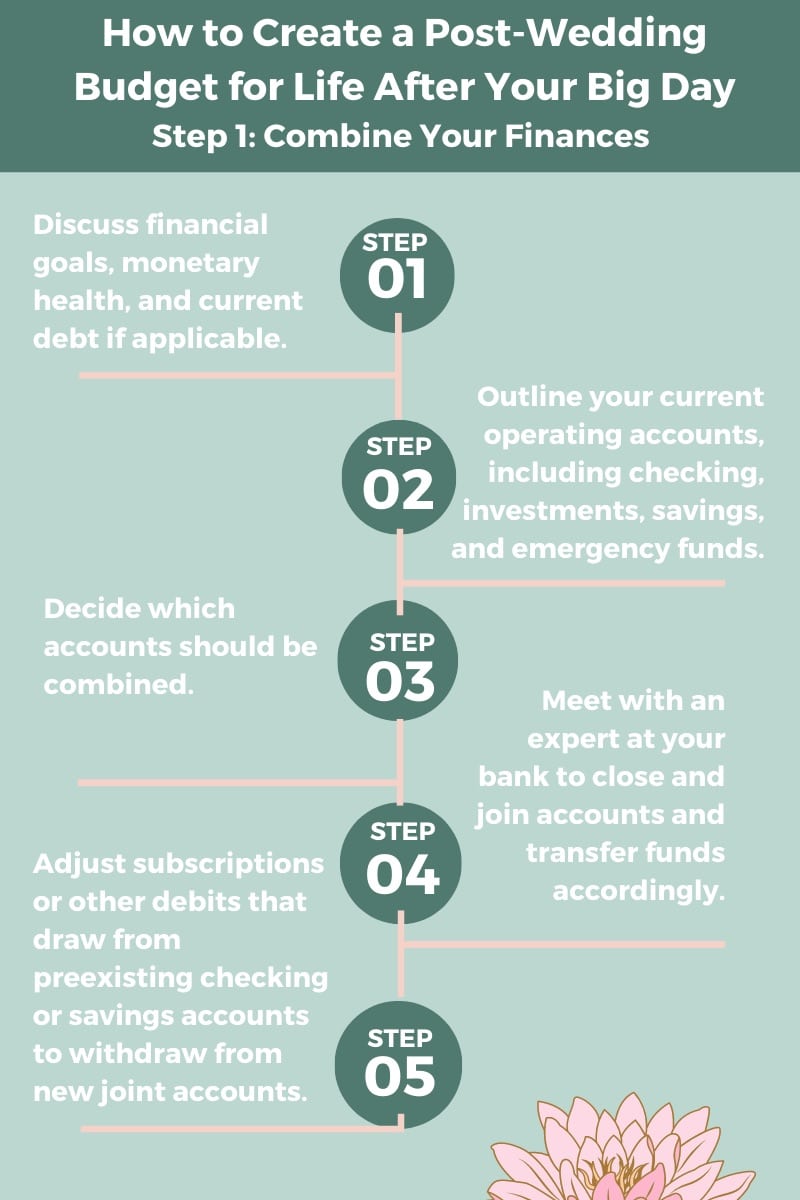

Combine Your Finances

Even after saying “I do,” it can be intimidating to discuss finances with a partner. To ease some of the stress, try to keep an open mind and be honest about your financial situation and spending habits. The more transparency, the easier it will be to organize your accounts.

If you’re unsure of where to begin, create a plan of action that outlines these steps:

- Discuss financial goals, monetary health, and current debt if applicable.

- Outline your current operating accounts, including checking, investments, savings, and emergency funds.

- Decide which accounts should be combined. It is suggested to combine savings and checking, seeing as shared household expenses are most commonly withdrawn from these accounts.

- Meet with an expert at your bank to close and join accounts and transfer funds accordingly.

- Adjust subscriptions or other debits that draw from preexisting checking or savings accounts to withdraw from new joint accounts.

Once you have checked all of the boxes on your action plan and have successfully combined your finances, it’s time to start reevaluating your budget.

Design a Budget

A budget can be curated in whatever way works best for you and your partner, so long as it documents the money you are bringing in and the money you are spending. To start your budget, you’ll need to combine your net monthly incomes. In the case you are both salaried, this number should remain stable. If you are self-employed, have commission-based pay, or work seasonally, you will want to adjust this number on a monthly basis to keep your budget as accurate as possible.

Once you have your monthly net income calculated, make a list and subtract your variable and fixed expenses. The money you have left after deducting these costs can then be divided into a savings account, emergency fund, and spending cash. If you’re unsure of just how much to allocate to the various sections of your budget, most financial advisors suggest the 50/30/20 rule. 50% of your net income goes to fixed expenses, 30% is for spending, and 20% goes into a savings or emergency fund. This rule will vary depending on your lifestyle, but it’s a good rule of thumb to start with when creating your monthly budget.

Set Financial Goals Together

Setting financial goals together is a major step in this new season of your lives, and it goes beyond just deciding on the monetary factors. Sit down together and review your personal goals, like buying a home you both love, having children in the future, achieving your career aspirations, and all the milestones in between. Having an idea of what you want to accomplish both individually and as partners can help you to set aside the right amount of money for short- and long-term goals. Here are a few major financial goals to help get you thinking ahead:

Buying Your Dream Home

If you plan on taking the big leap and buying your first home together, think about where you stand financially and how much house you can afford with your current budget. If your current savings don’t fit your dream home price, you may want to wait to buy and increase your savings contribution. Look for starter homes within your budget in the meantime, and use the ROI to buy your dream home in the future.

Starting a Family

If you plan on having children, saving for the expenses that come with them, especially when it comes to their education, can never start too soon. Before you plan on starting your family, set aside a section in your savings plan dedicated to the unexpected costs that may arise. This will ease some financial stress and keep that money out of sight out of mind in a designated emergency fund. Once you have children, only use this account for larger cost items or when otherwise necessary. Consider setting up an investment as well, like a custodial brokerage account, so your children can begin saving and learn healthy money management habits from day one!

Professional Goals

With your income stemming from your career, it’s important to factor in your professional goals and how they will impact your finances. Career changes happen often, and sometimes can cause financial worry. It is suggested to save approximately three to six months worth of living expenses in an emergency fund. This will give you enough reserves to manage time between career shifts without having to stress, and it is especially helpful if you are making the change to self-employment. Be sure to monitor and update your budget accordingly to keep track of your spending and account for additional income through promotions or raises.

Planning for life post wedding can be overwhelming, especially when it comes to talking finances. But, with the help of these steps, we hope the conversation will be a little easier and something you work on as partners as you begin your life together.